What Is Personal Property Tax Used For In Missouri . Personal property tax is a tax based upon the value of taxable personal property. Web you must pay individual consumer’s use tax on your purchase of tangible personal property stored, used, or consumed in. Web personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later. Web every person owning or holding real property or tangible personal property on the first day of january, including all such property. Information about paying the personal property tax in the city of st. For real property, the market value is determined as of january 1 of the. Web in missouri, personal property tax works by levying a tax on certain types of tangible personal property owned or. Web the assessor determines the market value of the property. Web what is personal property tax?

from www.signnow.com

Web the assessor determines the market value of the property. Information about paying the personal property tax in the city of st. Web you must pay individual consumer’s use tax on your purchase of tangible personal property stored, used, or consumed in. Personal property tax is a tax based upon the value of taxable personal property. Web every person owning or holding real property or tangible personal property on the first day of january, including all such property. Web personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later. Web what is personal property tax? For real property, the market value is determined as of january 1 of the. Web in missouri, personal property tax works by levying a tax on certain types of tangible personal property owned or.

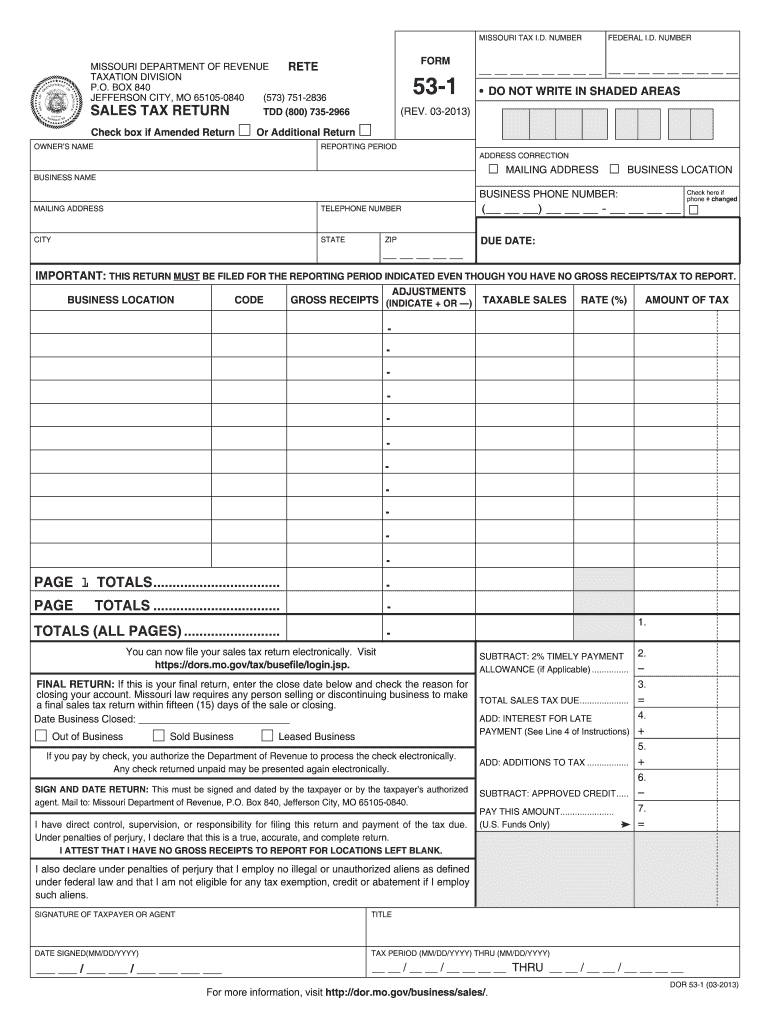

Missouri Sales Tax Form 53 1 Instruction Fill Out and Sign Printable

What Is Personal Property Tax Used For In Missouri For real property, the market value is determined as of january 1 of the. Information about paying the personal property tax in the city of st. Web the assessor determines the market value of the property. Web personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later. Personal property tax is a tax based upon the value of taxable personal property. Web every person owning or holding real property or tangible personal property on the first day of january, including all such property. Web you must pay individual consumer’s use tax on your purchase of tangible personal property stored, used, or consumed in. Web what is personal property tax? Web in missouri, personal property tax works by levying a tax on certain types of tangible personal property owned or. For real property, the market value is determined as of january 1 of the.

From stlplaces.com

How Is Personal Property Tax Calculated in Missouri in 2024? What Is Personal Property Tax Used For In Missouri Web every person owning or holding real property or tangible personal property on the first day of january, including all such property. Web the assessor determines the market value of the property. Web in missouri, personal property tax works by levying a tax on certain types of tangible personal property owned or. Personal property tax is a tax based upon. What Is Personal Property Tax Used For In Missouri.

From taxfoundation.org

Tangible Personal Property State Tangible Personal Property Taxes What Is Personal Property Tax Used For In Missouri Web every person owning or holding real property or tangible personal property on the first day of january, including all such property. Web the assessor determines the market value of the property. Web personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later. Personal property tax is a tax. What Is Personal Property Tax Used For In Missouri.

From www.taxuni.com

Missouri Personal Property Taxes What Is Personal Property Tax Used For In Missouri Web you must pay individual consumer’s use tax on your purchase of tangible personal property stored, used, or consumed in. Personal property tax is a tax based upon the value of taxable personal property. Information about paying the personal property tax in the city of st. Web every person owning or holding real property or tangible personal property on the. What Is Personal Property Tax Used For In Missouri.

From www.templateroller.com

Form MOPTC 2022 Fill Out, Sign Online and Download Printable PDF What Is Personal Property Tax Used For In Missouri Web every person owning or holding real property or tangible personal property on the first day of january, including all such property. Web what is personal property tax? Web in missouri, personal property tax works by levying a tax on certain types of tangible personal property owned or. For real property, the market value is determined as of january 1. What Is Personal Property Tax Used For In Missouri.

From www.formsbank.com

Fillable Form MoPtc Property Tax Credit Claim 2016 printable pdf What Is Personal Property Tax Used For In Missouri Web what is personal property tax? Web the assessor determines the market value of the property. Personal property tax is a tax based upon the value of taxable personal property. Web personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later. Web in missouri, personal property tax works by. What Is Personal Property Tax Used For In Missouri.

From taxfoundation.org

Tangible Personal Property State Tangible Personal Property Taxes What Is Personal Property Tax Used For In Missouri Personal property tax is a tax based upon the value of taxable personal property. Web what is personal property tax? Web in missouri, personal property tax works by levying a tax on certain types of tangible personal property owned or. Web you must pay individual consumer’s use tax on your purchase of tangible personal property stored, used, or consumed in.. What Is Personal Property Tax Used For In Missouri.

From www.ksdk.com

Missouri personal property taxes due at the end of December What Is Personal Property Tax Used For In Missouri Information about paying the personal property tax in the city of st. Web personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later. Web every person owning or holding real property or tangible personal property on the first day of january, including all such property. Web the assessor determines. What Is Personal Property Tax Used For In Missouri.

From barkerliff.fr.gd

barkerliff missouri personal property tax leased car What Is Personal Property Tax Used For In Missouri Information about paying the personal property tax in the city of st. Web the assessor determines the market value of the property. Web you must pay individual consumer’s use tax on your purchase of tangible personal property stored, used, or consumed in. For real property, the market value is determined as of january 1 of the. Web every person owning. What Is Personal Property Tax Used For In Missouri.

From www.youtube.com

27,000 St. Louis Co. personal property tax bills delayed YouTube What Is Personal Property Tax Used For In Missouri Web in missouri, personal property tax works by levying a tax on certain types of tangible personal property owned or. Personal property tax is a tax based upon the value of taxable personal property. Web the assessor determines the market value of the property. Web every person owning or holding real property or tangible personal property on the first day. What Is Personal Property Tax Used For In Missouri.

From rmofstclements.com

Property Tax Info Rural Municipality of St. Clements What Is Personal Property Tax Used For In Missouri Information about paying the personal property tax in the city of st. Web you must pay individual consumer’s use tax on your purchase of tangible personal property stored, used, or consumed in. Web the assessor determines the market value of the property. Web every person owning or holding real property or tangible personal property on the first day of january,. What Is Personal Property Tax Used For In Missouri.

From www.countyforms.com

How Do I Get A Property Tax Form.from.my County What Is Personal Property Tax Used For In Missouri Information about paying the personal property tax in the city of st. For real property, the market value is determined as of january 1 of the. Web what is personal property tax? Web the assessor determines the market value of the property. Web personal property taxes are levied annually against tangible personal property and due upon receipt of the tax. What Is Personal Property Tax Used For In Missouri.

From www.pdffiller.com

2022 Form MO MOPTC Chart Fill Online, Printable, Fillable, Blank What Is Personal Property Tax Used For In Missouri Personal property tax is a tax based upon the value of taxable personal property. Web what is personal property tax? Web the assessor determines the market value of the property. Web personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later. Web in missouri, personal property tax works by. What Is Personal Property Tax Used For In Missouri.

From www.signnow.com

Jefferson County Personal Property Tax 20222024 Form Fill Out and What Is Personal Property Tax Used For In Missouri Web personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later. Web in missouri, personal property tax works by levying a tax on certain types of tangible personal property owned or. Web what is personal property tax? For real property, the market value is determined as of january 1. What Is Personal Property Tax Used For In Missouri.

From www.pinterest.com

How to Deduct Property Taxes On IRS Tax Forms Irs tax forms, Mortgage What Is Personal Property Tax Used For In Missouri Web personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later. Web what is personal property tax? Web you must pay individual consumer’s use tax on your purchase of tangible personal property stored, used, or consumed in. Web every person owning or holding real property or tangible personal property. What Is Personal Property Tax Used For In Missouri.

From www.countyforms.com

Loudoun County Personal Property Tax Form What Is Personal Property Tax Used For In Missouri Web every person owning or holding real property or tangible personal property on the first day of january, including all such property. Information about paying the personal property tax in the city of st. For real property, the market value is determined as of january 1 of the. Personal property tax is a tax based upon the value of taxable. What Is Personal Property Tax Used For In Missouri.

From www.dochub.com

Missouri property tax credit form Fill out & sign online DocHub What Is Personal Property Tax Used For In Missouri Web personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later. Web in missouri, personal property tax works by levying a tax on certain types of tangible personal property owned or. Web the assessor determines the market value of the property. Information about paying the personal property tax in. What Is Personal Property Tax Used For In Missouri.

From www.pdffiller.com

Missouri Mo706 Form Sample Fill Online, Printable, Fillable, Blank What Is Personal Property Tax Used For In Missouri Information about paying the personal property tax in the city of st. Personal property tax is a tax based upon the value of taxable personal property. Web every person owning or holding real property or tangible personal property on the first day of january, including all such property. Web the assessor determines the market value of the property. Web you. What Is Personal Property Tax Used For In Missouri.

From www.templateroller.com

Form MOPTC 2022 Fill Out, Sign Online and Download Printable PDF What Is Personal Property Tax Used For In Missouri For real property, the market value is determined as of january 1 of the. Information about paying the personal property tax in the city of st. Web you must pay individual consumer’s use tax on your purchase of tangible personal property stored, used, or consumed in. Personal property tax is a tax based upon the value of taxable personal property.. What Is Personal Property Tax Used For In Missouri.